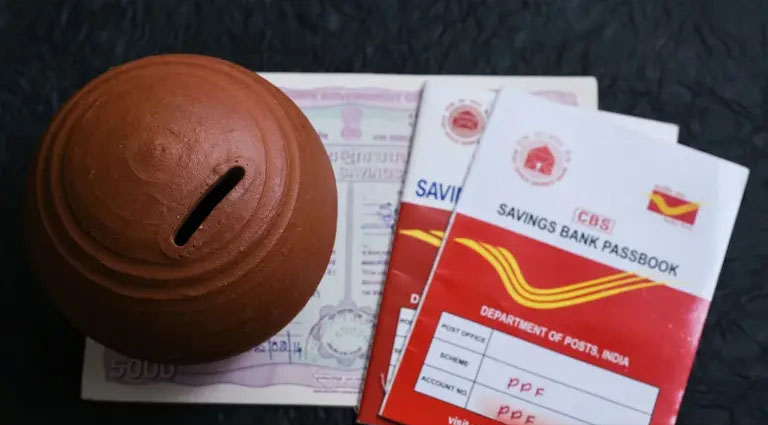

The Public Provident Fund (PPF) scheme administered under the Post Office’s Small Savings Schemes is going to undergo three major changes. This change will be effective from 1 October 2024 i.e. from next month. The Ministry of Finance has issued guidelines in this regard. This is a scheme that comes with a maturity period of 15 years and can make you a millionaire in the long run. Let’s know about this scheme in detail today.On August 21, 2024, the Department of Economic Affairs of the Union Ministry of Finance has issued guidelines on new rules, under which three new rules of PPF will be implemented. Apart from this, the rules of Sukanya Samriddhi Yojana and NSC will also be changed. These guidelines explain in detail the regularization of irregular accounts in three different cases ranging from minors to NRIs.

1st rule- PPF account opened in the name of minor :

Interest on such irregular accounts will be paid on Post Office Savings Account (POSA) till the time the person is eligible to open the account. That is, till the person turns 18, after which the PPF interest rate will be paid. Maturity period will be calculated from the date on which the minor becomes an adult. That is, from that date one becomes eligible to open the account.

Another rule – More than one PPF account :

The primary account will earn interest as per scheme, provided the amount deposited is within the applicable maximum limit for each year. The remaining amount in the second account will be credited to the first account. Any additional account other than primary and secondary accounts will earn 0 (Zero) percent interest from the date of account opening. That is, even if more than one account is opened, the interest under the PPF scheme will be earned on only one account.

Third change- Expansion of PPF account by NRIs :

Only active NRI PPF accounts opened under PPF, 1968 where the residential status of the account holder is not specifically asked in Form H. Account holders (Indian citizens who become NRIs during the account opening period) will be paid interest at POSA rate till 30 September 2024. Thereafter 0 (Zero) interest rate will be applicable on these accounts from October 1.